Save smartly. Save on the go.

You are the smart one. Save your money with NKOD. Let your money make more money for you!

Bank Grade Security

Our payment processors are PCI-DSS compliant to ensure security of your data electronically. Your funds are safe and secured with our payment processing partners, Paystack. The security of your money and the protection of your account is our priority. We are committed to its security because trust is our currency, we earn trust by ensuring the protection.

Don’t loss sleep on your funds with Us

Start Now

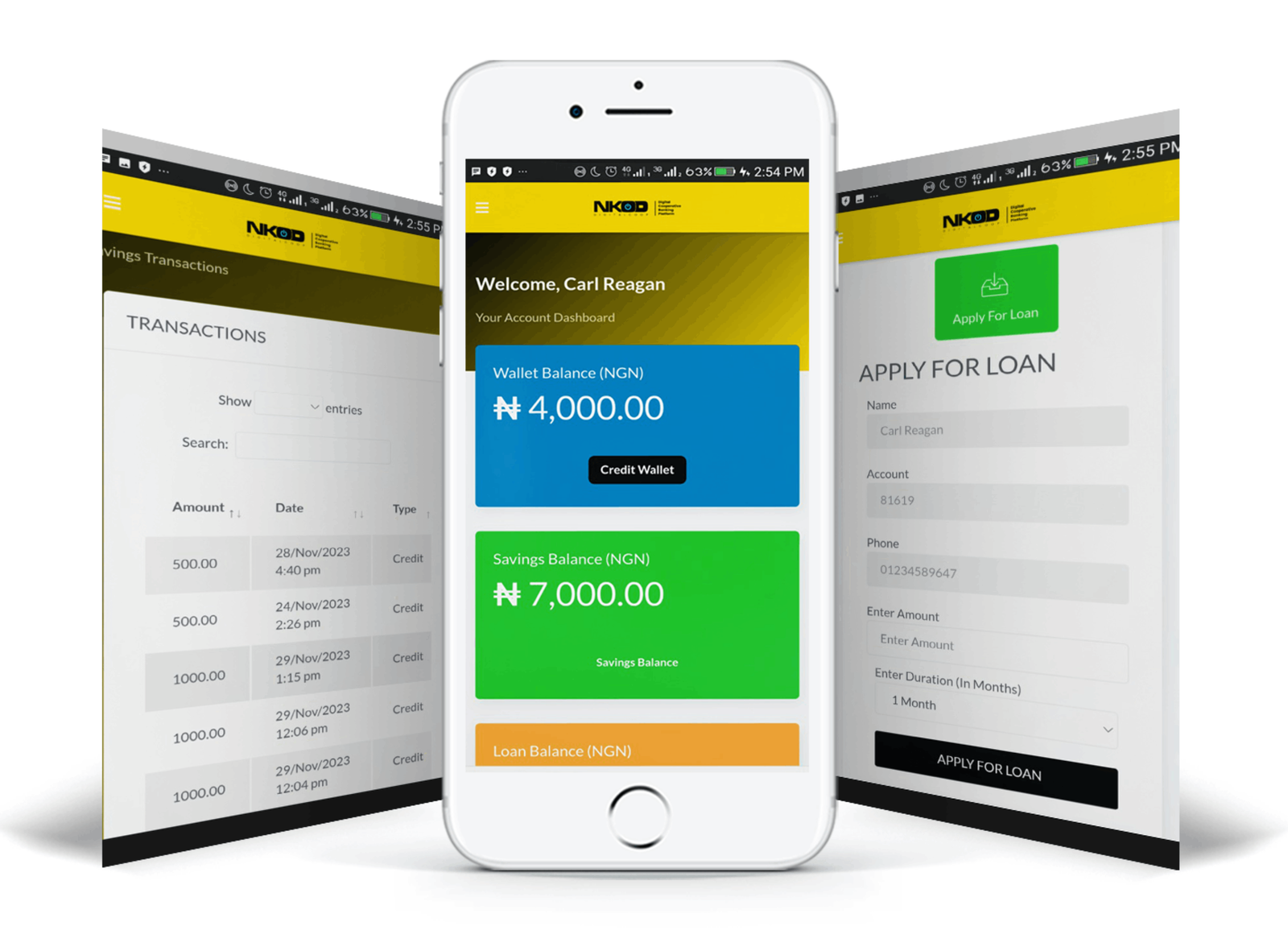

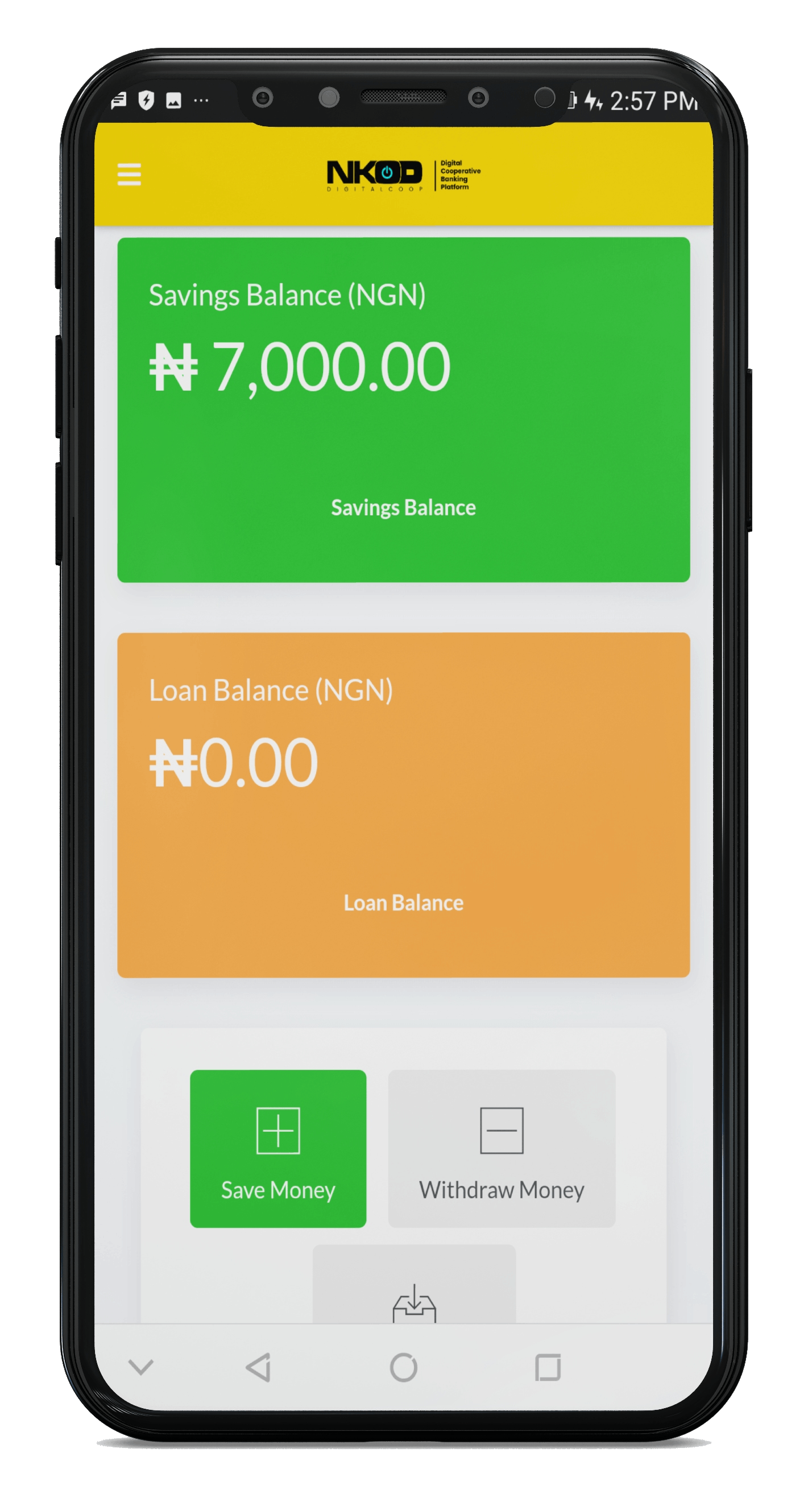

Savings Module

Easy Buy Savings

We call it smart consumers! You call it easy buy. Buy without hassles from any vendor, NKOD got you covered. Save to acquire at maturity your dream assets.

Start SavingSmart Savings

Build credibility and watch your savings grow. Save alone on everyday savings plans, weekly, monthly or quarterly basis. Withdraw at maturity. You can’t go wrong with smart savings.

Start SavingPeer to Peer Savings

Collective peer savings. Call it rotative group savings, we call it group savings or peer to peer contribution. Take turn to collect your contribution. Default savings covered by NKOD. Choose how to save and turn to collect your contribution.

Start Saving

How it works

It is simple and Transparent.

Sign up as a new user, login as a returning member with your account number or email.

Choose saving model which suites your need, amount and tenure or setup peer savings or rotational contribution.

Fund your account (Thrift)Easily. Using your debit card, USSD Code via your phone or through mobile agents indicating your NKOD account number.

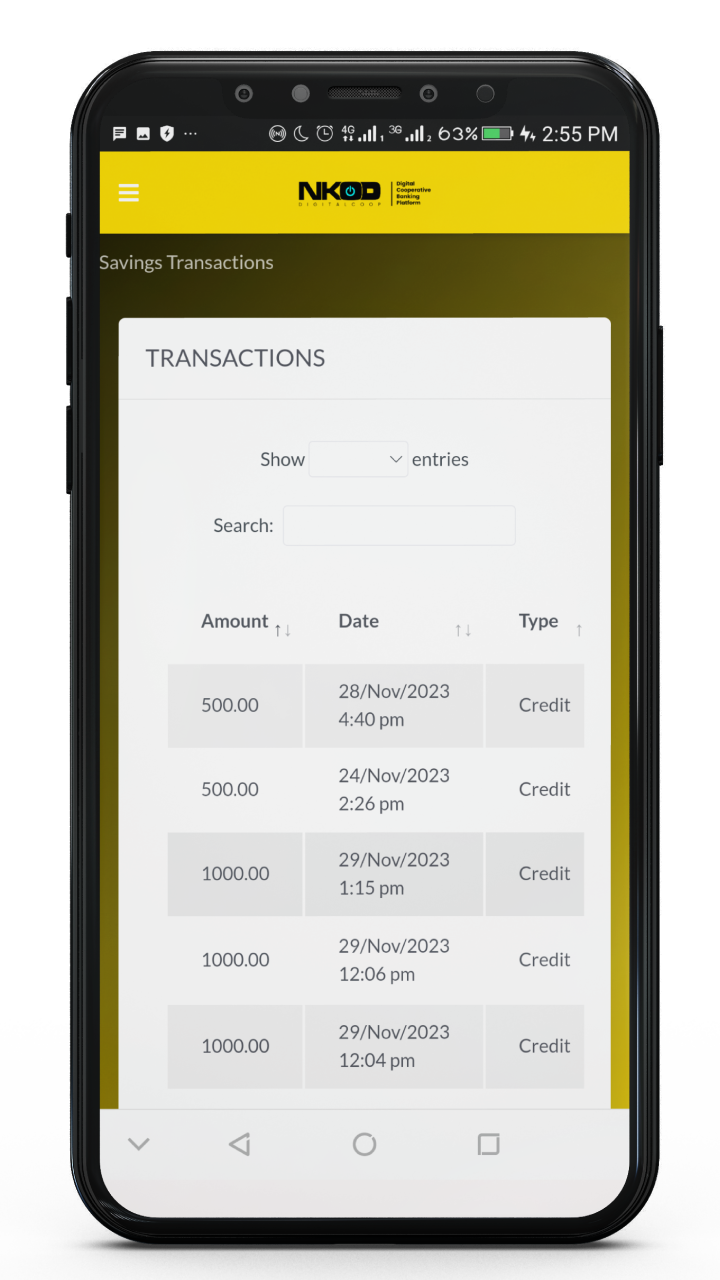

Get notify of every single transaction, view history, pending transactions, balance and more.

Achieve target amount, transfer or withdrawal safely and securely

Whatever your savings goal,

NKOD can help you achieve it!

Whether it is savings / contribution for a wedding, to buy consumables, pay rent, family vacation, to get a higher university degree, save for assets acquisition, or save for raining days. We got you covered.

Why NKOD Savings?

These and more are reasons smart savers prefer and uses NKOD:

Save easily > Watch your savings grow> Reach your savings goal.

Frequently Asked Questions

- Bank transfer using any debit card issued by Nigerian Bank

- Mobile transfer

- POS transfer with your account number embossed as the transferor/ depositor on the POS transfer description.

Nkod have multiple security and safety layers embedded on our platform such as Bank Grade Security in NKOD platform and our payment processors are PCI-DSS compliant to ensure security of customers data electronically. All cards and bank data are encrypted to prevent unauthorized access to sensitive information.

Setting a savings goal is only the beginning, achieving the goal is a kettle of fish. With NKOD, you can achieve more.

Refer & Earn

Refer 20 individuals and earn #100NGN each

Recommend NKOD to your friends, family and colleague or associates, we’ll give you both #100 Naira if they become a member of NKOD and open Every day smart savers with us.

Eligibility criteria and T&Cs apply

Isn't what you’re looking for?

Contact our support team

Call Us

Partners we have worked with